In the fast-paced world of Forex trading, a deep understanding of market trends and the factors that influence price movements is essential for success. One critical concept that plays a significant role in order execution is "absorption." This article explains absorption, its relevance to trading volume and price changes, and how it affects demand and supply dynamics.

What Is Absorption?

In the trading context, absorption refers to the market's ability to absorb the pressure exerted by buying or selling at a specific price level. It indicates a situation where the supply and demand for a particular currency pair reach a balance point, resulting in a temporary pause or slow price movement. Absorption can be further classified into two types: Selling and Buying.

Selling Absorption

Selling Absorption occurs when aggressive sellers, who primarily focus on the current price, encounter buy-limit orders placed by passive buyers at a specific price level. Traders in this group may fear missing out on opportunities if they refrain from trading. Meanwhile, the buy limit orders gradually absorb the sellers' sell market orders or supply.

Buying Absorption

On the other hand, Buying Absorption is the opposite of Selling Absorption. In this case, sell limit orders absorb buy market orders or demand from buyers. Traders who place sell limit orders or buy limit orders at specific desired prices are often institutional investors or large-scale investors who trade in high volumes. Ensuring sufficient opposing orders at the specified price level is crucial for these traders. The orders from this group absorb the supply or demand from aggressive traders.

The outcome of absorption is that the price stops moving forward if the orders from aggressive traders are not sustained enough to overcome the limit orders placed by large-scale investors. The price often bounces off the absorption area because aggressive traders need to limit their risks when the price moves against them and starts favoring the opposing side.

Understanding absorption and its impact on supply and demand dynamics can provide valuable insights for traders in assessing market conditions and making informed trading decisions.

How Does Absorption Affect Demand and Supply?

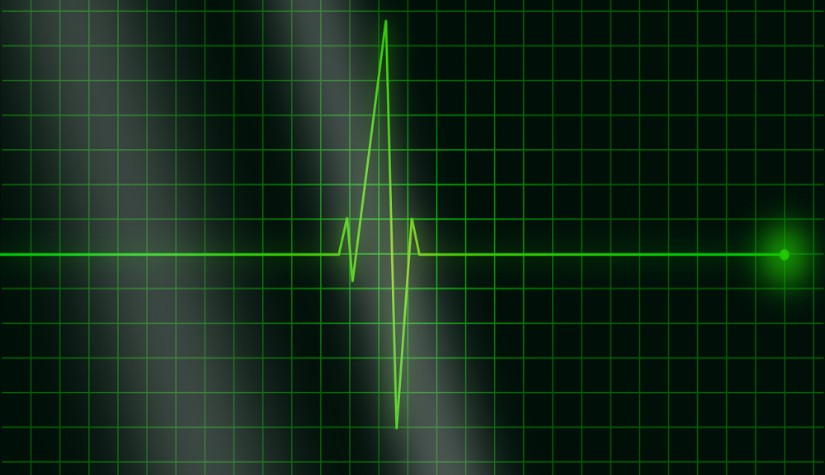

Absorption directly impacts demand and supply by offering insights into changing market dynamics. Based on these changes, it helps traders identify entry and exit points in the market. Based on the following image, let's examine how absorption affects demand and supply in different scenarios.

Scenario 1: Sharp Price Decline (Number 1 in the image)

Aggressive sellers encounter buy-limit orders in a specific area, resulting in a sharp price decline. These buy-limit orders represent swap demand from large investors who aim to prevent prices from dropping below that level. By placing buy limit orders, these investors intend to absorb market sell orders generated by profit-taking or short-term trading strategies that involve only market orders. Numerous limit orders can halt the price movement caused by market orders. Subsequently, if there is an increase in trading activity or if the group that initiated sell positions exits the market, the price cannot break through this level. As a result, they must exit their positions to limit their risk. The exit of this group makes it easier for the price to increase since there are no longer sell limit orders in the area where aggressive sell orders were initiated.

Scenario 2 and 3: Aggressive Buy Orders (Numbers 2 and 3 in the image)

In these scenarios, aggressive buy market orders encounter sell limits placed by more prominent players in specific areas. The absorption principle states that when these traders cannot overcome that area, the price often returns from that level as they must exit the market to limit their risk. The more the price moves against them, the quicker they must exit. This explanation illustrates that market orders do not necessarily originate from new trading activity but can also arise from traders leaving the market.

Scenario 4: Rapid Price Increase (Number 4 in the image)

When the price rapidly increases because buyers do not want to miss out on entering, it may be due to the observation that the price broke through a lower area after ranging for a while. When the price reaches the area marked as number 4, the limit orders placed by large investors will absorb the buy market orders until they are exhausted. The price does not proceed further and starts to bounce back due to the presence of trapped traders who opened buy market orders and need to manage their orders to limit potential losses. If the price declines, the losses will increase, making it even more necessary for them to exit the market. Hence, a significant number of sell market orders are generated.

In all these examples of absorption, it causes demand and supply to switch and change automatically. Market orders, whether they are buy or sell orders, encounter limited orders placed by large investors who want these orders to enter the market at desired levels. If the traders cannot break through that specific level, this group of traders will voluntarily exit the market. This self-exit from the market leads to the generation of many market orders.

Conclusion

Understanding the concept of absorption is crucial for traders to comprehend market trends and the balance between demand and supply. It enables them to gain confidence and accuracy in their trading decisions. However, it's important to note that absorption is just one component of trading strategies, and traders should consider it alongside other technical and fundamental factors to develop effective trading strategies.

______________________________

Maximize your knowledge: Blog

Keep up to date on global events: News

Updated

10 months ago

(Jun 26, 2023 17:24)