Indicators, or Indie, are critical tools in technical analysis. They are highly effective tools that will make your trading more effective. By using the indicators, you will be able to identify trends, support-resistance, candlestick charts, and chart patterns.

Moreover, in Forex trading, an indicator is a thing that may give information for your trading. For example, it might indicate the direction of the candlestick chart's trend. Moreover, some indicators can predict where orders will be placed. Significantly, technical analysis traders employ indicators to assess price direction and make trading decisions. This is another effective Forex trading technique. However, there are several other advantages of indicators.

Advantages of Indicators

Purpose of the Indicator

Each indication is designed to serve a different purpose. Therefore, we must first comprehend the intended purpose of the indication we need to use. If you use an indicator for the wrong purpose, it may be unable to extract its effectiveness. We can divide indicators into 5 main types as follows:

1. Indicators used to determine the direction of a trend, such as Moving Average and Parabolic SAR.

2. Indicators used to confirm the strength or reliability of a certain direction, such as ADX, OBV.

3. Indicators used to measure centrifugal force or Momentum, such as CCI, RSI, and Stochastic.

4. Indicators used to measure volatility, such as the ATR and Historical Volatility.

In addition to the above-mentioned five types of indicators, there are a number of others that may be used for a variety of purposes. Nevertheless, indicators are designed to serve different purposes. Therefore, when selecting an indicator, we should know its intended usage. As a result, when using indicators, you will better analyze the market conditions. Nevertheless, finding an indicator is not difficult.

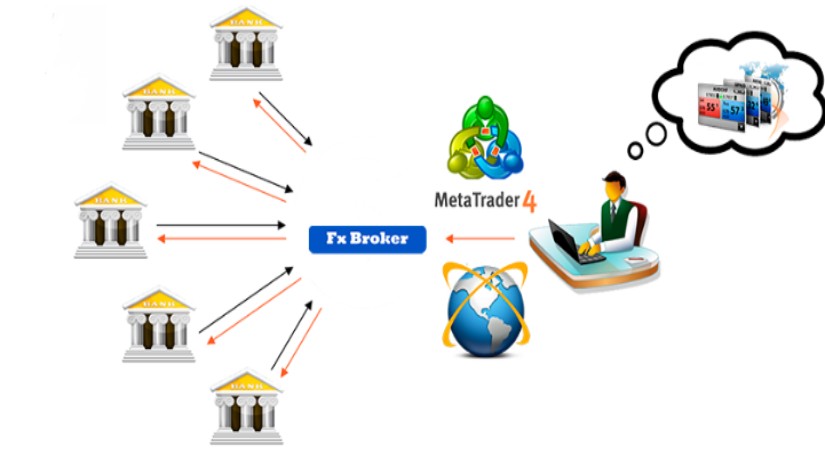

When trading in MT4, MT5, you can click “Insert” and then click the term Indicators, as seen in the image below.

The Using of Indicators

The following are suggestions for choosing indicators.

1. Determine the graph's trend first, as determining it wrong might result in severe errors

2. Choose no more than two indicators for your trading. However, you should remember that putting too many indies may produce problems with your trading strategy.

3. Don't be emotional; have faith in your indicators. Normally, indicators take the correct amount of turns six to ten times.

4. Don't set too big lots. You should always remember that the distinction between trading and gambling lies in the preparation involved and the capacity to manage one's emotions.

Recommended Indicators for New Traders

You must first comprehend the objective of indicators. Moreover, you should not use indicators designed for the same purpose simultaneously. For example, you should not use the RSI, the CCI, and the Stochastic simultaneously. The reason is that each indication provides the same perspective. Therefore, using several indicators cannot improve the validity of the analysis's findings.

Conclusion

However, using indicators is only one key in the journey to market survival. The reason is that to become a professional trader in the Forex market, you must have the following three components: method, money management, and mindset. As a result, these three components will ensure your market sustainability.

____________________________________________

Maximize your knowledge: Articles

Keep up to date on global events: News

Explore in-depth analysis: Technical Analysis